Average full coverage auto insurance costs $2,697 per year nationally in 2026, up 6% from last year due to higher repair costs and claims trends. This guide helps drivers compare top companies, understand coverage options, and find savings through discounts and smart shopping. Families, young drivers, and high-risk profiles can cut premiums by hundreds with the right choices.

Auto insurance protects your finances after accidents, theft, or damage. Every state requires minimum liability coverage, but full policies add collision and comprehensive for better protection. Use comparison tools below to get personalized quotes from providers like GEICO, Progressive, and USAA.

Table of Contents

Auto Insurance 101

Liability coverage pays for others’ injuries or property damage if you cause an accident. State minimums vary, such as $25,000/$50,000 bodily injury in California, but experts recommend higher limits like 100/300/100 to avoid out-of-pocket costs.

Full coverage includes collision (your car repairs) and comprehensive (theft, weather). Exclusions often apply to wear-and-tear, racing, or business use, so review policy fine print.

| Coverage Type | What It Covers | 2026 National Avg Annual Cost | Key Exclusions |

|---|---|---|---|

| Liability Only | Others’ damage/injuries | $685 | Your vehicle repairs |

| Full Coverage | Liability + Collision + Comprehensive | $2,697 | Normal wear, intentional acts |

| Add-Ons (e.g., Roadside) | Towing, rental car | $50-200 | Frequent use |

Pricing factors include age (teens pay 2x more), location (urban ZIPs higher), driving record (DUI adds 80%), credit score, and vehicle type (EVs cost 10-20% more). Telematics programs like Progressive Snapshot track habits for up to 30% discounts.

2026 trends show premiums rising from EV battery repairs and inflation. Bundle home/auto for 25% savings; safe driver courses cut another 10%.

Best Auto Insurance Companies Ranked

Top companies excel in rates, satisfaction, and coverage based on J.D. Power scores, NAIC complaints, and Quadrant rate data. GEICO leads for clean records with easy online quotes; Progressive suits high-risk drivers via flexible options.

Travelers Pros: Lowest rates, strong claims handling. Cons: Fewer local agents. Sample quote: 35yo clean record in Texas, $185/month full coverage.

Amica Pros: Top satisfaction, accident forgiveness. Cons: Higher for young drivers. Ideal for families needing reliability.

USAA Pros: Military perks, superior app. Cons: Eligibility limited. Rates beat competitors by 20-30% for vets.

Progressive Pros: Forgiving for tickets/DUIs, Name Your Price tool. Cons: Average satisfaction. Snapshot app saves safe drivers $300+ yearly.

GEICO Pros: Fast quotes, broad discounts. Cons: Claims process varies. Best starter for low-mileage drivers.

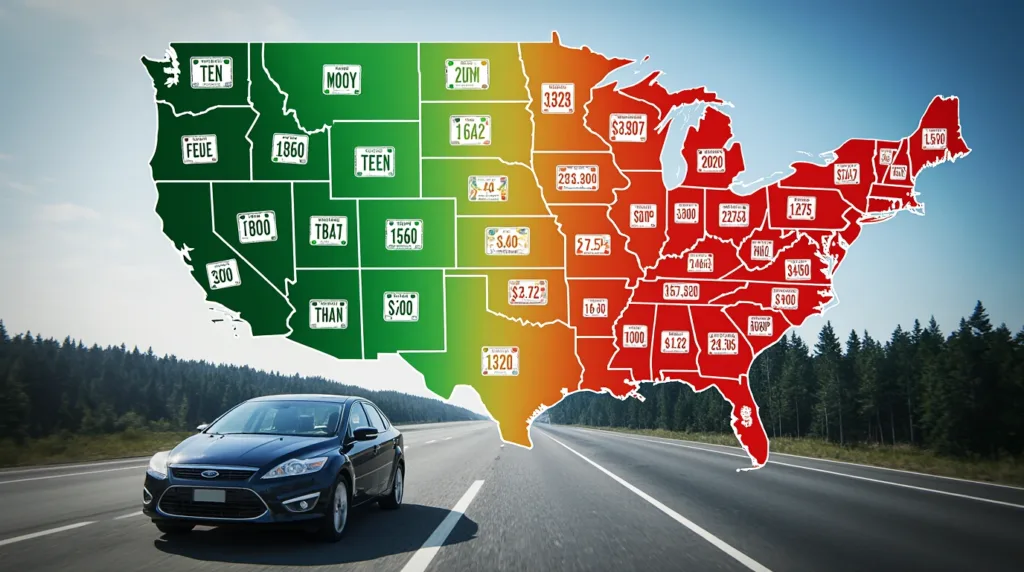

Auto Insurance Rates by State & Profile

Rates differ widely by state due to regulations, theft, and weather. Michigan averages $4,500 full coverage; Hawaii $1,800 minimum.

| State | Min Coverage Avg | Full Coverage Avg | High-Theft ZIP Example |

|---|---|---|---|

| California | $650 | $2,800 | Los Angeles: +25% |

| Texas | $700 | $2,400 | Houston: +15% |

| Florida | $950 | $3,600 | Miami: +40% |

| National | $685 | $2,697 | – |

By Profile:

- Clean record adult: $1,800 full.

- Teen added to policy: +$1,500.

- DUI: +80% ($4,800 avg).

- Multi-car bundle: -20%.

Stack discounts: Good student (15%), anti-theft device (5-10%). Check your state’s DMV site for minimums.

How to Get Cheap Auto Insurance Quotes

Learn how to compare auto insurance quotes online and secure the best rates for 2026, covering top companies, coverage types, discounts, and state-specific savings. This step-by-step process takes under 15 minutes and can save hundreds annually.

Total Time: 4 minutes

Gather Your Information

Assess Coverage Needs

Decide on liability only ($685 avg) or full coverage ($2,697 avg) based on car value and loan status. Note add-ons like roadside assistance or rental reimbursement.

Get Multiple Quotes

Compare Rates and Discounts

Use tables to review premiums, J.D. Power scores, NAIC complaints. Apply discounts: bundling (25%), safe driver (15%), telematics (up to 30%). Calculate total savings.

Review Policy Details

Check exclusions (e.g., racing, business use), claims process, and cancellation terms. Contact agent for questions; verify state compliance.

Purchase and Activate

Select best quote, pay deposit online or via app. Download proof of insurance ID cards, set autopay, and enroll in telematics for extra savings. Review policy within 14 days.

Supply:

- Internet access

- Valid driver's license

- Vehicle details (VIN, make, model, mileage)

- Personal info (ZIP code, age, driving history)

- State minimum coverage knowledge

Tools:

- Comparison sites (e.g., Insurify, Quote.com)

- Insurance company websites (GEICO, Progressive)

- Calculator for discounts

- State DMV/insurance department site

Materials: Vehicle VIN or plate number Recent driving record (tickets, accidents) Credit score (optional for quotes) Current policy details (if switching)

Most quotes take 2-3 minutes. Shop every 6-12 months or after life changes.

Frequently Asked Questions

How much does auto insurance cost?

National averages are $685 minimum, $2,697 full coverage. Varies by state/driver.

Best auto insurance for high-risk drivers?

Does credit affect auto insurance rates?

Yes in most states (except CA, HI); good credit saves 40%.

Is full coverage worth it?

Yes if car value >$4,000 or financed; otherwise liability suffices.

Car insurance for teens?

Add to parents’ policy for discounts; usage-based apps cut costs.

Does bundling save money?

25% average on auto/home; shop both policies.

Next Steps for Your Auto Insurance

Match your profile to top picks: Clean record? GEICO. Military? USAA. High-risk? Progressive.

Compare free quotes now from multiple carriers. Visit your state insurance department site for regulations and full policy details before deciding. Schedule annual reviews and enable telematics for ongoing savings. Drive protected today.